Minimum wage calculator after tax

Also known as Net Income. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

How To Calculate Gross Income Per Month

You must be at least 23 years old.

. To calculate the after-tax income simply subtract total taxes from the gross income. That means that your net pay will be 43324 per year or 3610 per month. United States US Salary After Tax Calculator.

Your employer withholds a 62 Social Security tax and a. For example lets assume. United States US Salary After Tax Calculator.

Minimum Wage Salary After Tax. Tax composition Summary After paying tax and ACC the amount of income from a. How to Calculate Salary After Tax in California in 2022.

The average monthly net. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Minimum WageSalary After Tax.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. Your average tax rate. Apr 07 2022 The formula for after-tax income is quite simple as given below.

On The Adult Minimum Wage annual salary you will pay 630000 PAYE tax and 60736 ACC. Using The Hourly Wage Tax Calculator. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Your employer owes you past payments from the previous year because of underpayment. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. National Minimum Wage and Living Wage calculator for workers.

You can see a list of tax tables supported here with details on tax credits rates and thresholds used in the Salary Calculator. The money you take home after all taxes and contributions have been deducted. 1 The minimum wage in Ireland in 2022 2 The Irish national average salary in 2022 Gross Salary Take-Home Pay Effective Tax Rate Tax Due.

The money you take home after all taxes and contributions have been deducted. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. That means that your net pay will be 43041 per year or 3587 per month.

But calculating your weekly take. If you make 55000 a year living in the region of California USA you will be taxed 11676. This places US on the 4th place out of 72 countries in the.

Using The Hourly Wage Tax Calculator. How Your Paycheck Works.

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Calculator In Python Payroll Python Computer Programming

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Simple Tax Refund Calculator Or Determine If You Ll Owe

Federal Income Tax Calculator Atlantic Union Bank

Tax Calculator Estimate Your Income Tax For 2022 Free

Easiest 2021 Fica Tax Calculator

Download Salary Arrears Calculator Excel Template Exceldatapro Excel Templates Excel Salary

Advisor Tool Survivor Income And Cash Needs Analysis Worksheet Life Insurance Calculator Life Insurance Companies Life Insurance

According To Tax Foundation California Ranks 49 In Migration Of Personal Incomes Map Illinois State Map

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

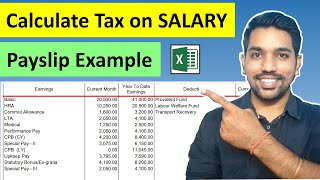

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Payroll Tax Calculator For Employers Gusto

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Net Pay Step By Step Example

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate